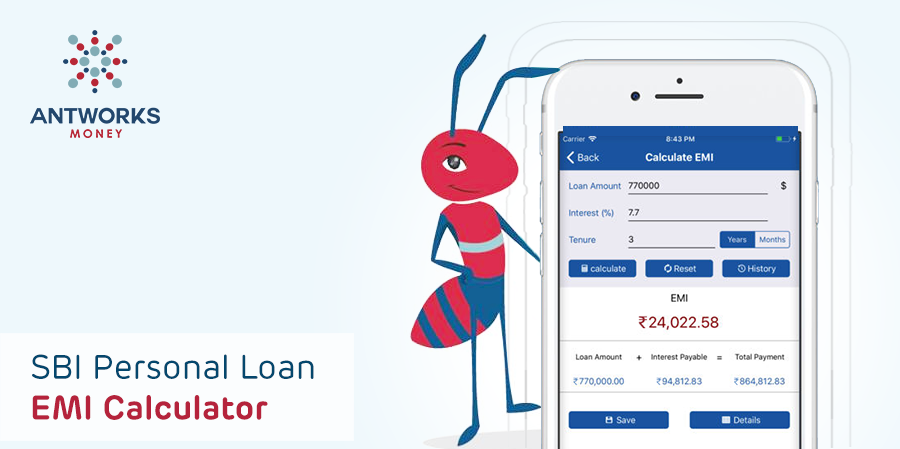

SBI Personal Loan EMI calculator that helps you gauge your eligibility and how much you can borrow for a specific tenure. Such online calculators help you to get an idea of how much you will have to keep aside from your monthly income towards EMI.

Perks of SBI Personal Loan EMI Calculator

- Helps you understand if you are eligible to apply at the bank or not.

- You can get to know how much would be the monthly payments during the term opted.

- You can also find out the current interest rate of the bank and use it to get the exact EMI.

- In case the organization you work at has their corporate/salary account with SBI, you can avail offers made only to direct customers.

- Based on the terms and conditions put forward by SBI, there are many features that you can avail. For instance, you can pay back partially or settle the entire loan before the tenure ends.

- The leeway to some extra every month will help you save on interest. This is particularly helpful if you have taken an unsecured personal loan from the bank.

- You may also negotiate a bit on the rate. It just might work.

- Swift disbursal of the loan and minimal paperwork is what entices customers.

What the personal loan EMI calculator cannot tell you

- Approval of your personal loan application to SBI is completely at the discretion of the loan manager. EMI calculator cannot predict the outcome.

- There is no guarantee that the interest rate given will not vary as per the current trends.

- Pre-payment penalty might apply.

A GST rate of 18% will be applicable on banking services and products from 01 July, 2017.