The repo rate cut by Reserve Bank of India (RBI) announced on 02 August, 2017, has also affected the bank rate. The bank rate was adjusted to 6.25% p.a. against the repo rate of 6.0%. During the Monetary Policy Committee (MPC) meeting held on 7 February 2018, it was announced that the repo rate will remain unchanged.

What is Repo Rate?

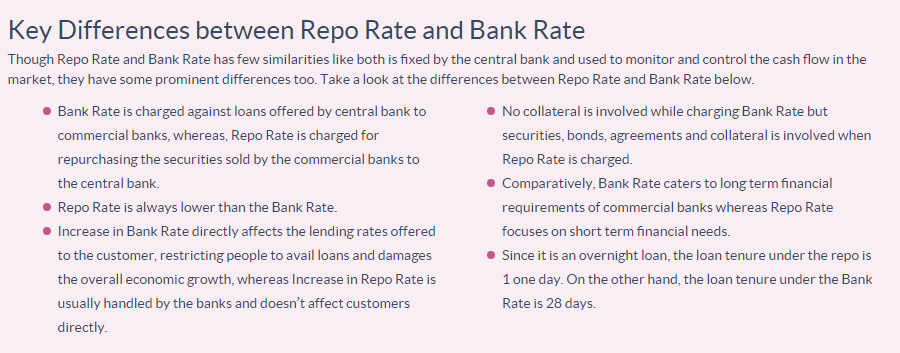

When we experience a financial shortfall, we approach the bank for loans. Likewise, when banks fall short of funds, they approach the central bank for financial assistance. Repo Rate is the rate at which the country’s central bank, which is RBI in India, lends money to commercial banks during a financial crisis. In other words, commercial banks borrow money from Reserve Bank of India by selling securities or bonds with an agreement to repurchase the securities on a certain date at a predetermined price. The rate of interest charged by the central bank on the cash borrowed by commercial banks is called the “Repo Rate”. For example: if the Repo Rate is 10% and the loan amount borrowed by a commercial bank from RBI is Rs.10,000, the interest paid to the RBI will be Rs.1,000.

What is Bank Rate?

The rate of interest charged by the central bank on the loans they have extended to commercial banks and other financial institutions is called “Bank Rate”. In this case, there is no repurchasing agreement signed, no securities sold or collateral involved. Banks borrow funds from the central bank and lend the money to their customers at a higher interest rate, thus, making profits. Bank Rate is usually higher than Repo Rate as it is an important tool to control liquidity. Also known as “Discount Rate”, Bank Rate is often confused with Overnight Rate. While the bank rate refers to the interest rate charged by the central bank on loans granted to commercial banks, overnight rate is the interest charged when banks borrow funds among themselves. When Bank Rate is increased by RBI, the borrowing costs of the banks increase which, in return, reduce the supply of money in the market.