Education loans or student loans have emerged as one of the most prominent loan categories. Students who could not earlier go for higher studies due to fund crunch can now avail an education loan and realize their dreams.

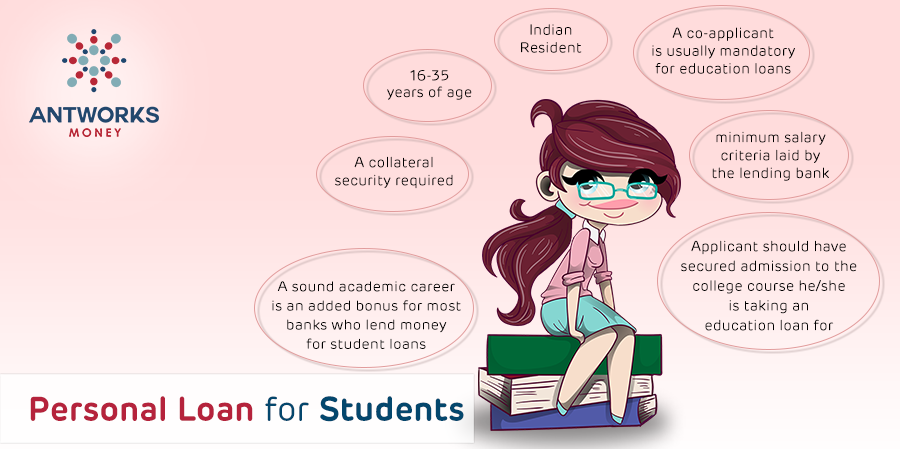

Student Loan Eligibility Criteria

To avail an education loan from a lending entity, there are certain eligibility criteria that need to be fulfilled by the loan applicant. Listed below are some general criteria that apply to almost all banks.

- Applicant needs to be an Indian resident

- Applicant should be aged between 16-35 years of age

- A collateral security is required by most banks if the loan amount is more than a specific limit

- A co-applicant is usually mandatory for education loans. A co-applicant can be a parent or spouse

- Co-applicants salary should meet the minimum salary criteria laid by the lending bank

- Applicant should have secured admission to the college course he/she is taking an education loan for

- A sound academic career is an added bonus for most banks who lend money for student loans

Documentation Required for a Student Loan

There is a specific set of documents required by banks for sanction of education loans. This list of documents is similar for all lending entities. Following are the papers that need to be furnished by an education loan applicant.

- Proof of age, school certificates

- Proof of permanent address

- Proof of identity, passport, voter ID, driving license etc.

- Income proof of co-applicant/guarantor

- Optional guarantor form, duly filled

- Copy of admission letter to education course

- Bank account statements of co-applicant if required by the bank

Student Loan Interest Rates

Interest rates on education loans are slightly higher than loans for housing. These rates are dependent on the lending bank and are generally in the range of 11.75 percent per annum and 14.75 percent per annum. Rates are relaxed for students who secure admission at premier institutes like IITs and IIMs. Interest rates are also reduced by public sector banks for female applicants.

Features and Benefits of Student Loans

Student loans are a great boon for people who want to study but struggle due to financial constraints. The concept of banks paying for your education while you study and then getting repaid when you start earning is a great boost for banks as well as for your own educational growth. Here are some of the most significant features and advantages of student loans in India.

- Education loan enables you to realize your dreams by taking care of education expenses

- Student loans are easy to obtain and do not have stringent requirements to be fulfilled. This makes these loans popular among customers and removes the hurdle that finances could pose to the education of an individual.

- Student loans are a great alternative to other types of credit. These loans offer lucrative interest rates and come at easier terms as compared to other loans.

- Deferment of repayment is the most significant advantage of education loans. These loans can be deferred to a time until the applicant starts earning within a stipulated timeframe. The borrower isn’t required to repay the loan as soon as he/she avails an education loan.

- Student loans offer not just financial ease but also tax benefits. Interest paid towards education loan can be claimed for tax exemption under section 80E of the Income Tax Act.

- Many banks offer the top-up feature on education loans in case a student decides to continue study during the moratorium period. Repayment is then deferred by the bank until completion of the further study.

- The existence of one education loan in a family might affect the procurement of other education loans in the same family.

- For student loans higher than a specific loan amount, most banks require a collateral to be submitted as security. These collaterals can be anything like house papers, LIC policies, NSCs, fixed deposits etc.

Student Loan for Studying Abroad

Banks offer education loans not only to students who study in India but also to students who wish to study abroad. Generally, studying abroad is far more expensive than studying in India and hence students who wish to study abroad have to manage enough cash to get admitted to an educational institution.

Student Loan for Studying in India

Public sector banks, as well as private banks, offer education loans to students who wish to study in India. These loans can be taken for any professional course like MBA, engineering, medical etc. Sometimes, rates on education loans are slashed in case the college an applicant has got admission too is a premier institute like an IIT, IIM or an NIT.