How to File ITR and Submit ITR-V Online Through Bank Account

The Internet has made things simple and lethargic, however, its actual potential was released when the Government chose to embrace it for official work (we get a kick out of the chance to think so). It is such a help to have the capacity to record expense form and also present your ITR-V (that is your Income Tax Return Verification Form) online by means of your financial balance – it has made the procedure a mess more straightforward.

Details required before logging onto the site

The principal thing you require is net managing an accounting office and the arrangement to make e-payments. If you are a first-time client, i.e in the event that you have never e-documented your profits, you should make a record on the Income Tax Department’s site, www.incometaxindiaefiling.gov.in. Keep your PAN Cardnearby as you will require it to make a client name and watchword.

The site will remove some of your points of interest from your PAN Card, while you should enter other individual subtle elements yourself. Be cautious when you say your email address. This is essential as all correspondence relating to e-documenting will happen by means of the email address you give. When you have enlisted, an email will be sent to your enrolled mail affirming the enactment of your record. With this done, you are prepared to record your wage returns on the web. You should now pick the fitting ITR shape.

Steps to file Income Tax Return online using net banking:

- Sign into your net banking account and navigate to the income tax e-filing tab. If you are unable to locate it, check whether your back offers this facility. Clicking on the e-filing tab will take you to the Income Tax Departments website. (The same site on which you created an account).

-

- Create your profile. Get your login details.

- Thanks to your PAN number, most of your income details will already be available.

- Get your Form 26AS which will have the details of taxes that you have already paid. This includes the TDS deducted by your employer.

- Now click on the option ‘Submit Returns/Forms’.

- Next, select the relevant Income Tax Return Form (ITR 1/ITR 4S) and the assessment year. (You also have the option to download this form, fill it up and upload the filled form to the site.)

- Fill in your details carefully and click on submit. You can refer to your Form 16 and Form 26AS for the details. You need to furnish your bank details for receiving a refund if any.

- It’s not over. After you click on ‘submit’ an acknowledgment is displayed. This is your ITR-V form.

How to submit your ITR-V

- In the menu options, click on ‘Dashboard’. You will see an option which reads View ‘Returns/Forms’.

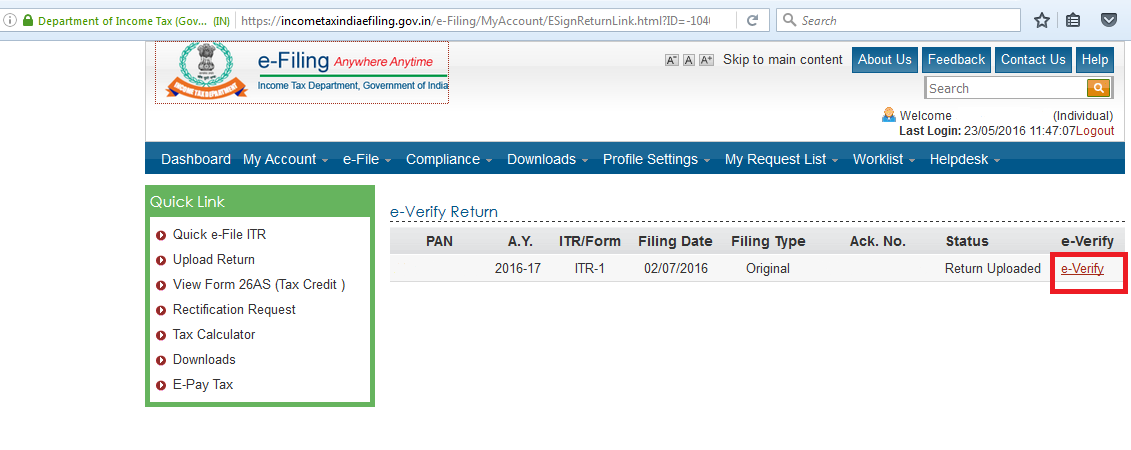

- Clicking this option will show a list of all your returns and their status. Under the status tab, you will see – ‘Returns uploaded, pending for ITR-V/E-Verification’.

- Click on e-verify. It’s as simple as that.

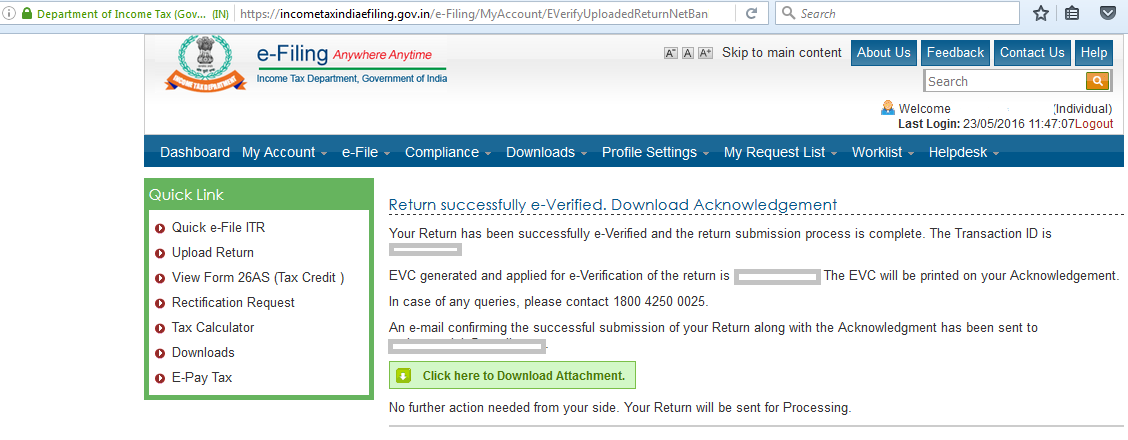

- Clicking on e-verify will open a pop-up window. Click on continue to get an electronic verification code (EVC) which is linked to your PAN. This is your income tax return verified. Bingo!

- You will also get a confirmation message on your screen stating the transaction ID and EVC code. You can download this for your reference.

You have successfully filed your returns! Put your feet up and relax.

Benefits of e-filing over paper filing

Filing taxes over the internet is definitely faster and a more efficient process. Instead of relying on the reliable Indian Postal Service to do the to and fro of documents for you, you can upload and download them in minutes or even better, just fill in your details online. Also, a lot of work is automated. You upload your tax documents and they are processed right away. In another few minutes, you receive an acknowledgment for your transaction. The best part being you can file your taxes safely.

Deadlines for filing returns

The last date to file your returns is 31st July 2016. For those who need to get their account books audited under the Income Tax Act, the last day is 30th September 2016.

The IT department is offering a one-time opportunity to get your returns of the last six years verified by 31st August 2016. Check all your IT returns from the assessment year 2009-2010 onwards for verification and make use of this one time scheme to get your IT Returns verified, failing which you can be liable for fines and scrutiny by the IT department.

Overview Of The ‘Amnesty’ Scheme

Using the current one-off window, you can regularise all old Income Tax returns from 2009-10 onwards by seeking online verification by 31st August 2016. This scheme is only valid if you have filled your ITR but have not been able to get your ITR-V from the department. The scheme does not allow you to file any fresh IT returns for previous years. All taxpayers who have filed their income tax return but for some reason did not get them verified, are eligible for this regularisation scheme. Remember that without the ITR-V (that is, your Income Tax return verification), your tax return is not considered valid.

Also, if you have not been able to receive your tax refunds because of non-verification of your tax return, this scheme offers a golden chance to not only regularise your ITR but also make way for your pending tax returns.