Do you dream of taking an overseas vacation with your family? Or are you looking to buy the latest Smartphone? Whatever be your needs, personal loans are here to your rescue. Banks and other NBFCs offer personal loans anywhere between Rs. 25,000/- to 25 lakhs. You can use this amount for anything from meeting hospital bills for a family member to going on a trip with your family.

Getting a personal loan is a simple process. Most lenders have an online application where you can fill in your details and the representative will get in touch with you. Short Term Personal Loans do not require any collateral or guarantor. All you need to do is submit proof of your eligibility and other supporting documentation.

Some Tips to ensure that you choose the Right Personal Loan for your needs

- Before you apply for a fast personal loan, try to gauge the maximum amount you’re capable of paying per month as EMI. Then try to check whether you’ll be able to afford this amount after meeting your other expenses and other loans Then apply for a loan amount that you’ll be able to fit within your income.

- Always apply for a loan amount that doesn’t impact your financial health in a bad way.

- The baseline here is all your EMIs shouldn’t be more than 50-60% of your monthly income.

- If you have already availed several other loans, look for options where you can consolidate all of them together as a single loan.

Factors that Influence your Personal Loan Rate

The interest rate for a personal loan is dependent on several factors. Understanding these factors is helpful to ensure that you get the best rate.

- Your CIBIL score and repayment history are checked by every bank to decide on your interest rate. Banks avoid sanctioning loans for people with poor credit history.

- Banks sanction loans faster for people who work in a reputed firm and have a steady stream of income.

- Banks have a list of purposes for which they authorize personal loans like a home renovation, wedding, travel or medical emergencies.

Now, that you are aware of the factors that determine your loan rates, it’s time to answer the question, “where to get personal loans?” Finding the right lender is made easy with the help of online loan calculators.

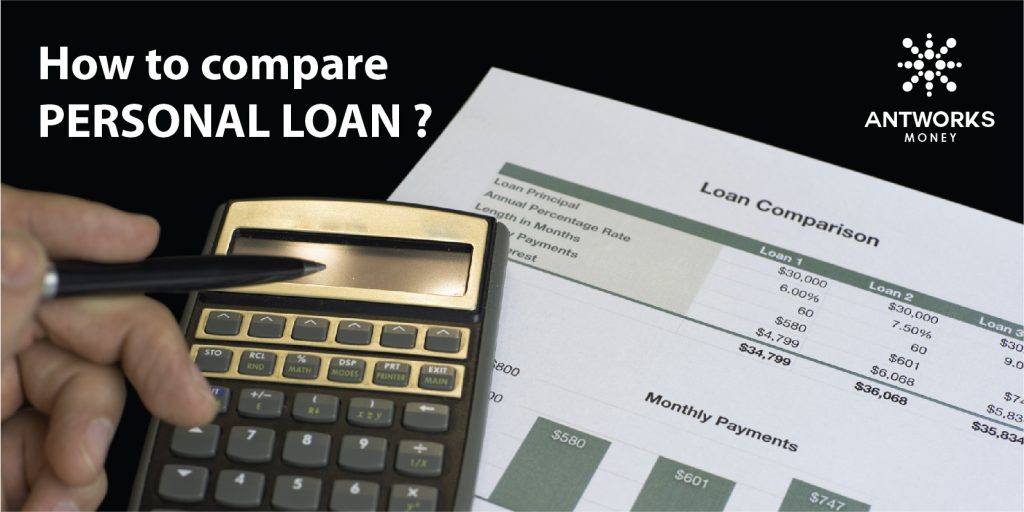

Steps in Comparing Personal Loans

- Choose a reputed online loan calculator.

- Key in your details like the loan amount, tenure.

- Enter in other secondary factors like your salary, age, location and so on.

- The calculator lists the interest rates at various banks and other NBFCs.

- You can then shortlist 4-5 banks and make inquiries at each one of them to determine the right bank for your needs.

- While comparing lenders, you must also consider the processing fees, early closure terms, prepayment penalty, and the penalty for defaulting on an EMI payment apart from the interest rates.

- After carefully analyzing all these factors, decide on the right lender for you who offers low rate personal loans.

The Bottom Line

Decide on your preferred lender only after a comparison of the available lenders with the help of a personal loan calculator, to assist you in finding the best rates and deals.